Federal Deficit & Debt

Q & A on the US Federal Deficit and Debt

What is the difference between Deficits and Debt?

The federal deficit is the annual difference between Government expenditures and revenue. In 2024 it was 1,850,000,000,000 ($1.85 Trillion)

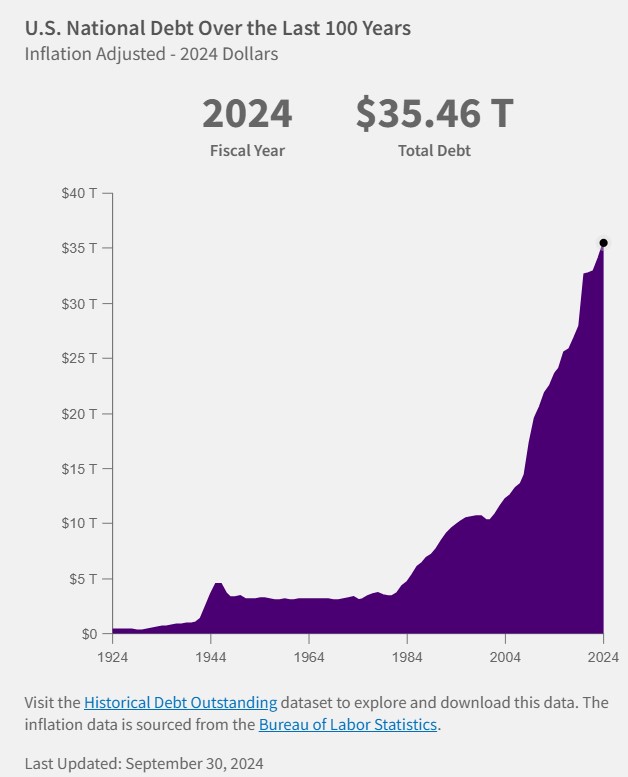

The Federal Debt is the total accumulation of this annual debt, which incurs interest costs. Currently, in 2024 it is $36,000,000,000,000 ($36 trillion).

Visualize Federal Revenue Sources and Outlays here https://usafacts.org/government-spending/

How bad is it?

Very bad. The current (2024) Federal debt is $36,000,000,000,000 ($36 Trillion).

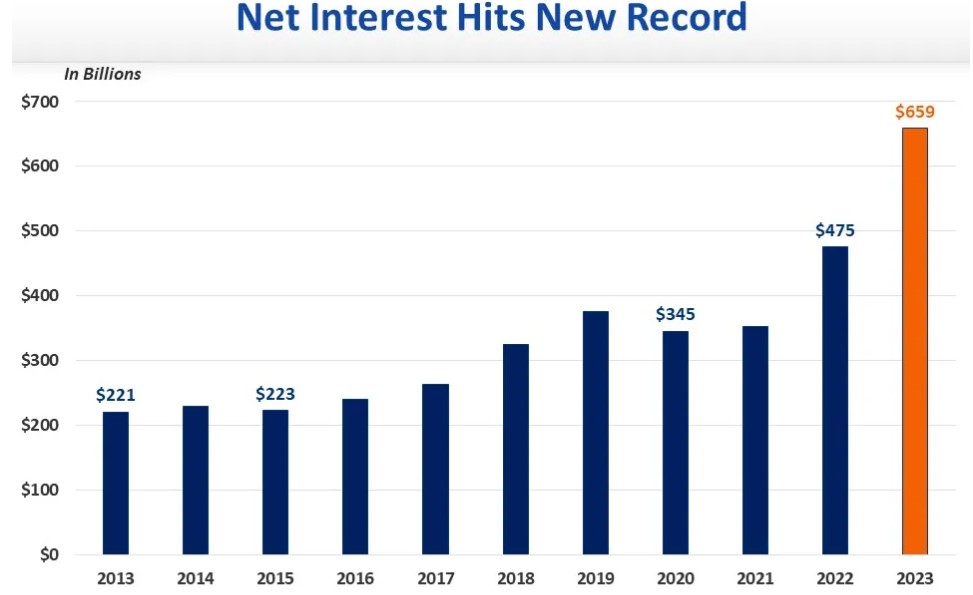

To put that in perspective, our entire annual federal budget is $6.75 Trillion with revenues of $4.9 trillion. The current annual interest on the Federal Debt is $882 Billion which is more than the entire defense budget and one of the largest expenses in government.

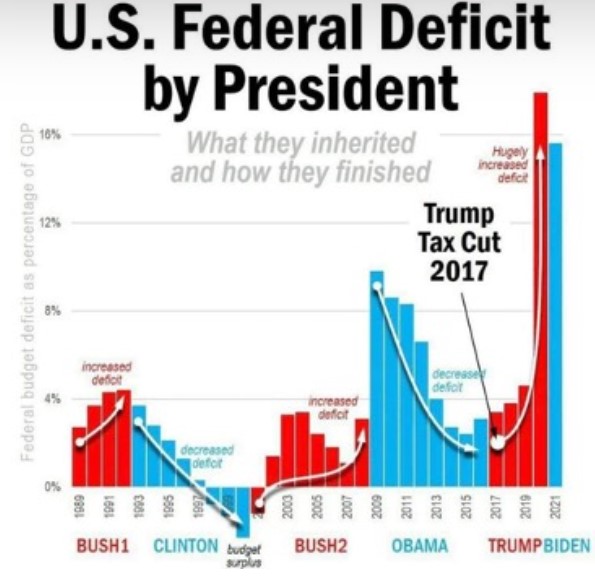

Since the Carter administration, the US has run a deficit almost every year that skyrocketed under the Regan administration and its tax cuts. The only years we had a surplus was under Bill Clinton due to a sizable tax increase that fell largely to the upper-income earners.

Because the Debt accumulates each year and must be financed, the national debt is creating an unsustainable burden on future generations who must pay the interest charges.

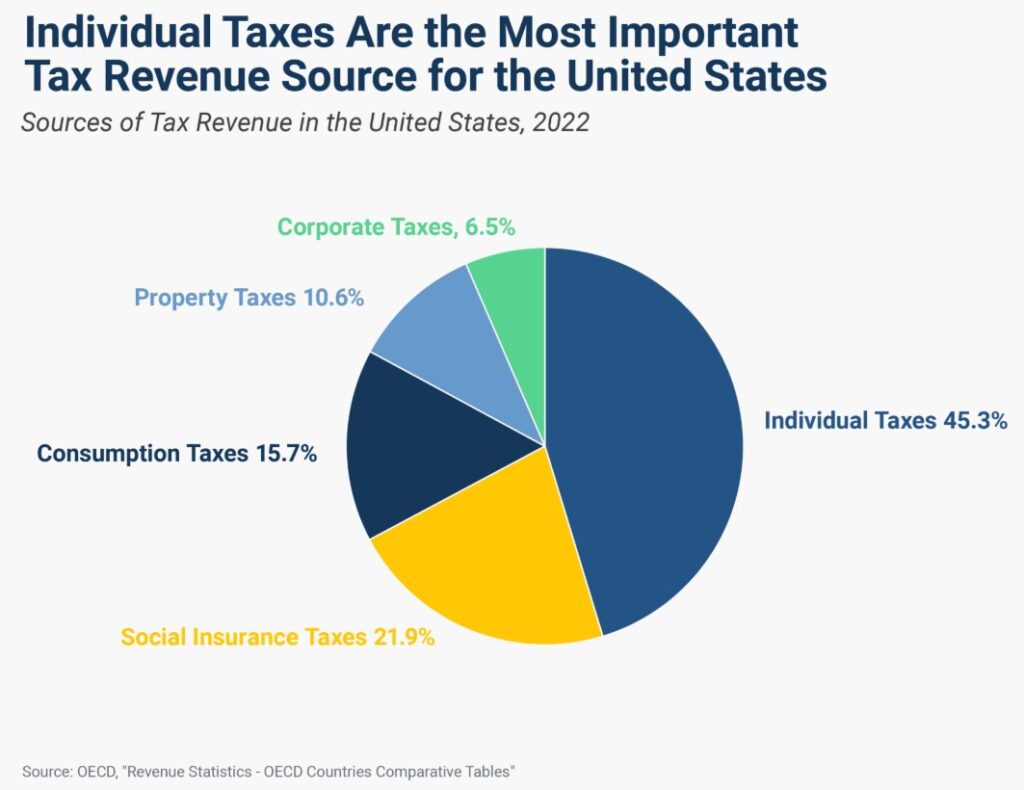

Where does the money come from and what is it spent on?

Here is where we get revenue.

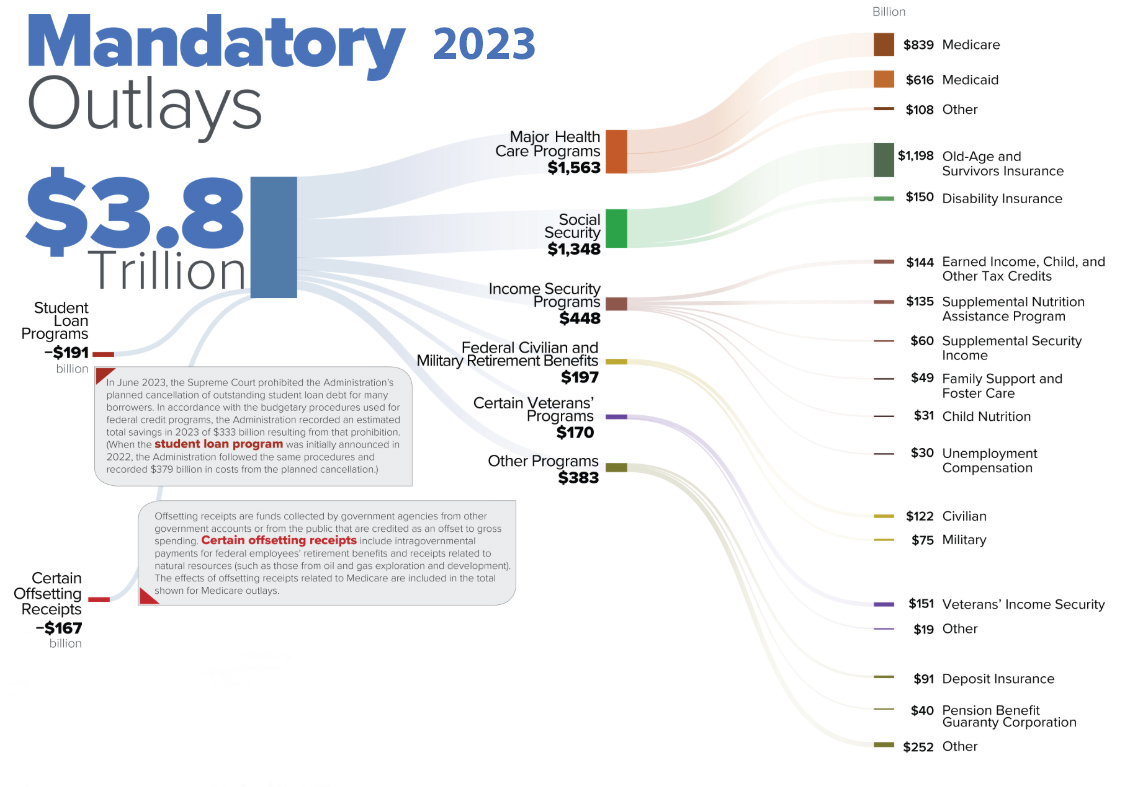

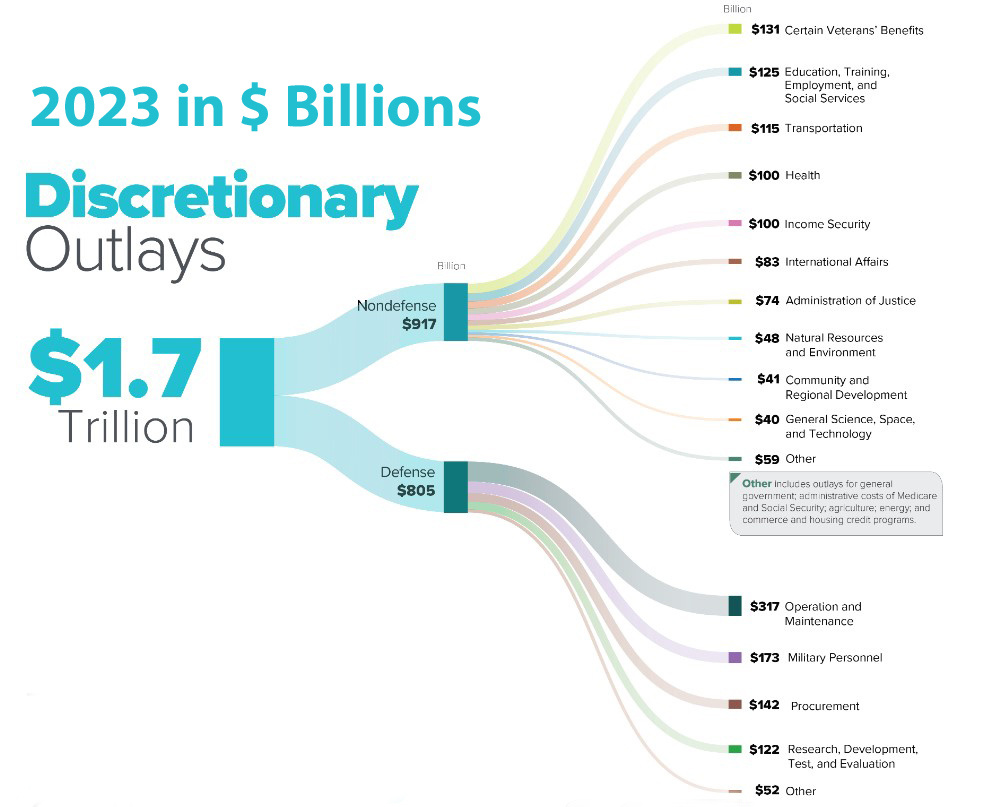

Here is where we spend the budget.

It is helpful to understand that the Federal Budget is authorized by Congress (not the President) and broken into mandatory and discretionary spending items. No single piece of legislation establishes the annual federal budget. Rather, Congress makes spending and tax decisions through a variety of legislative actions in ways that have evolved over more than two centuries.

As you can see, much of the Federal budget is Mandatory spending.

Overall the Federal Debt continues to skyrocket.

Interest costs on the federal debt continue to escalate, due to both annual deficits and higher interest rates.

The only way to reduce the Federal Debt is via both tax increases and reduced spending on many other programs. These involve hard choices.

Care to balance the federal budget yourself?

https://www.crfb.org/debtfixer

ACTION: Contact your Congressional representative and urge them not to support new tax cuts until the budget situation is properly addressed.

Resources:

Federal Budget explained:

https://www.cbpp.org/research/federal-budget/introduction-to-the-federal-budget-process

Debt explained:

https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

https://www.visualcapitalist.com/americas-debt-27-trillion-and-counting/

https://www.visualcapitalist.com/breaking-down-the-u-s-governments-2024-fiscal-year/