Save Social Security and Medicare

The Social Security Administration announced a “massive” reorganization and “significant” job cuts on Thursday that critics said could increase customer-service wait times and make it more difficult to detect fraud.

The SSA employs around almost 60,000 employees. Media reports said the cuts range from 7,000 workers to as many as 30,000 workers, or half of the agency.

The move comes after the SSA said this week it would close two of its offices — the Office of Civil Rights and Equal Opportunity and the Office of Transformation.

Social Security is facing a cash shortfall; the Social Security Trust Fund has been lumbering toward insolvency for years and are scheduled to be depleted in 2035. At that point, beneficiaries will receive only 83% of the promised benefits.

“Through these massive reorganizations, offices that perform functions not mandated by statute may be prioritized for reduction-in-force actions that could include abolishment of organizations and positions, directed reassignments, and reductions in staffing,” the agency said in a statement outlining the job cuts.

Contact your member of Congress.

If you live in the state of a Senator or the district of a House member, call them or write. Identify your members of Congress here.

If you live outside of their district or state ,comment on their social media (Facebook/Twitter).

“Almost everyone who has worked in Congress for more than a year as well as the Members live and die by 15 Facebook likes. The echo chamber is devastating.

— Republican staff member

House Subcommittee on Social Security

Social Security

The jurisdiction of the Subcommittee on Social Security shall include bills and matters referred to the Committee on Ways and Means that relate to the Federal Old Age, Survivors’ and Disability Insurance System, the Railroad Retirement System, and employment taxes and trust fund operations relating to those systems. More specifically, the jurisdiction of the Subcommittee on Social Security shall include bills and matters involving title II of the Social Security Act and Chapter 22 of the Internal Revenue Code (the Railroad Retirement Tax Act), as well as provisions in title VII and title XI of the Act relating to procedure and administration.

Majority Members – Republicans

Minority Members –Democrats

Senate Finance Subcommittee on Social Security, Pensions, and Family Policy

Majority – Republican

Minority –Democrat

House Subcommittee on Medicare

Subcommittee on Health

The health sector broadly, including private and public health insurance (Patient Protection and Affordable Care Act, Medicare, Medicaid, CHIP); biomedical research and development; hospital construction; mental health; health information technology, privacy, and cybersecurity; medical malpractice and medical malpractice insurance; the 340B drug discount program; the regulation of food, drugs, and cosmetics; drug abuse; the Department of Health and Human Services; the National Institutes of Health; the Centers for Disease Control; Indian Health Service; and all aspects of the above-referenced jurisdiction related to the Department of Homeland Security.

Labor, Health and Human Services, Education, and Related Agencies

Republican |

Democrat |

| Robert Aderholt (4D/AL)– Chair | Rosa DeLauro (3D/CT) – Ranking Member |

| Mike Simpson (2D/ID) | Steny HoyerM (5D)MD) |

| Andy Harris (1D/MD) | Mark Pocan (2D/WI) |

| Chuck Fleischmann (3D/TN) | Lois Frankel (22D/FL) |

| John Moolenaar (2D/MI) | Bonnie Watson Coleman (12D/NJ) |

| Julia Letlow (5D /LA) – Vice Chair | Josh Harder (9D/CA) |

| Andrew Clyde (9D/GA) | Madeleine Dean (4D/PA) |

| Jake Ellzey (6D/TX) | |

| Stephanie Bice (5D/OK) | |

| Riley Moore (2D/WV) |

Background on Social Security

Key Facts about Social Security

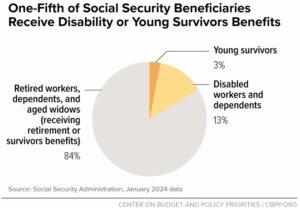

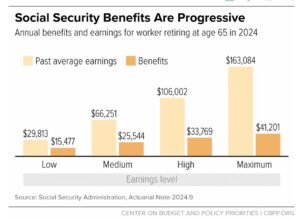

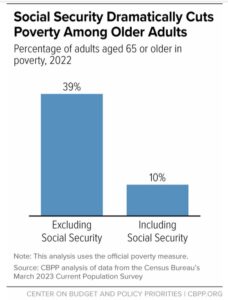

Social Security brings many important advantages. It provides a foundation of retirement protection for people at all earnings levels. It rewards personal saving and private pensions because it isn’t means-tested — it doesn’t reduce or deny benefits to people whose income or assets exceed a certain level. Social Security provides a higher annual payout than private retirement annuities per dollar contributed because its risk pool is not limited to those who expect to live a long time, no funds leak out in lump-sum payments or bequests, and its administrative costs are much lower.

Social Security is the largest source of income for most beneficiaries. For 4 in 10 retirees in 2015, it provided at least 50 percent of their income, and for 1 in 7 it provided at least 90 percent of income, according to Social Security Administration (SSA) research that combines survey and administrative data.

SOURCE: https://www.cbpp.org/research/social-security/top-ten-facts-about-social-security

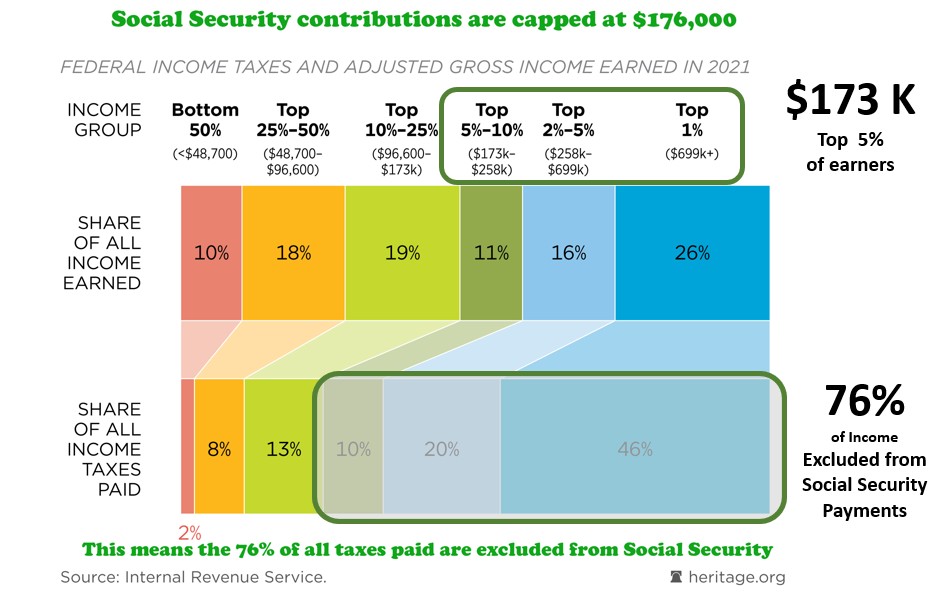

Only the first $176,000 of W-2 income is subject to Social Security taxes

This means that 3/4 of all US income is not taxed by Social Security.

Eliminating this cap would only affect the top 10% of wage earners and generate $3.2 trillion over 10 years. This one step represents over 50% of the 75-year funding gap.

The Social Security Trust Fund

Background on Medicare

Medicare vs Medicaid

People often confuse Medicare with Medicaid. They are two entirely different programs. Medicare and Medicaid were both enacted as part of the Social Security Act and the programs provide comparable services.

Medicare provides health insurance coverage to individuals who are age 65 and over, under age 65 with certain disabilities, and individuals of all ages with ESRD.

Medicaid provides medical benefits to groups of low-income people, some who may have no medical insurance or inadequate medical insurance.

Medicare is strictly a federal program. Although the federal government establishes general guidelines for Medicaid, the Medicaid program is administered by the states.

Medicare overview

Medicare is a broad program of health insurance designed to assist the nation’s elderly in meeting hospital, medical, and other health costs. Medicare is available to most individuals 65 years of age and older.

Medicare has also been extended to persons under age 65 who are receiving disability benefits from Social Security or the Railroad Retirement Board and those having End Stage Renal Disease (ESRD).

There are currently over 55 million people enrolled in Medicare.

The CMS is a federal agency within the United States Department of Health and Human Services that manages Medicare

Parts of Medicare

Medicare Supplemental Insurance (Medigap)

Extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare. Policies are standardized, and in most states named by letters, like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it.