Tax Cuts

The first question we should ask is WHY?

Although, to most people, the promise of tax cuts has appeal, but there is a cost to pay because we are running high annual deficits and tax cuts reduce tax revenue.

Next, we should ask who benefits from the Trump Tax cuts.

Let’s look back to the 2017 Trump tax cuts.

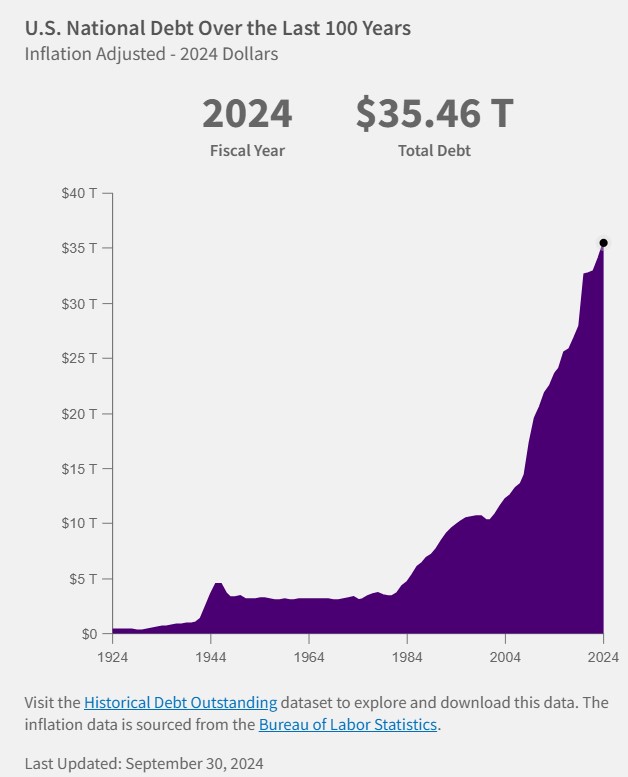

TOP LINE: The 2017 Tax cuts added $1.5 Trillion to the National debt over the next 10 years. https://taxpolicycenter.org/briefing-book/how-did-tcja-affect-federal-budget-outlook

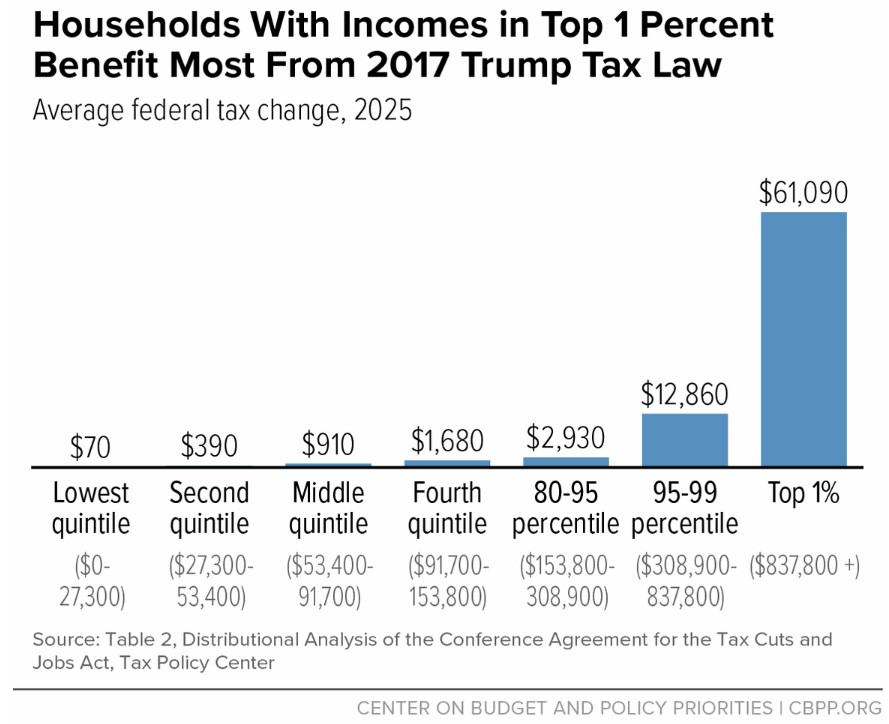

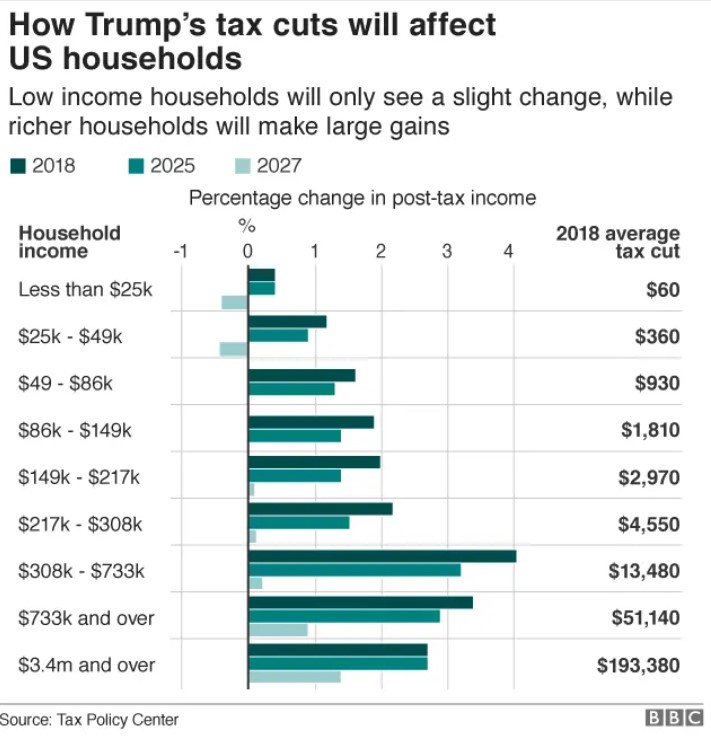

Most of these cuts went to corporations and top earners.

- Was skewed to the rich. Households with incomes in the top 1 percent will receive an average tax cut of more than $60,000 in 2025, compared to an average tax cut of less than $500 for households in the bottom 60 percent, according to the Tax Policy Center (TPC).[1]

- Was expensive and eroded the U.S. revenue base. The Congressional Budget Office (CBO) estimated in 2018 that the 2017 law would cost $1.9 trillion over ten years,[3] and recent estimates show that making the law’s temporary individual income and estate tax cuts permanent would cost another roughly $400 billion a year beginning in 2027.[4]

- Failed to deliver promised economic benefits. Trump Administration officials claimed their centerpiece corporate tax rate cut would “very conservatively” lead to a $4,000 boost in household income.[5] New research shows that workers who earned less than about $114,000 on average in 2016 saw “no change in earnings” from the corporate tax rate cut, while top executive salaries increased sharply.[6] https://www.cbpp.org/research/federal-tax/the-2017-trump-tax-law-was-skewed-to-the-rich-expensive-and-failed-to-deliver

What do the 2025 tax cuts propose?

Like the previous tax cuts, they will largely benefit the high-income earners and contribute $Trillions to the National Debt.

On a conventional basis, we estimate Trump’s proposed tax changes would reduce federal tax revenue by $3 trillion from 2025 through 2034. https://taxfoundation.org/research/all/federal/donald-trump-tax-plan-2024/

Individual Income Taxes: Lower Rates, Expanded Cuts Individual taxpayers may see a continuation of the lower income tax rates introduced by the TCJA, with support for making these rates permanent beyond their scheduled 2025 expiration. Trump has also proposed doubling the standard deduction, which would reduce taxable income for many households and retain current tax brackets, avoiding a return to higher, pre-2018 rates. Another key component includes the full reinstatement of the State and Local Tax deduction, which has been capped at $10,000 since the TCJA—an aspect that affected taxpayers in high-tax states.

Capital Gains and Investment Incentives Trump’s proposed tax policies may include changes to capital gains taxes as a way to encourage investment. Currently, long-term capital gains are taxed at 15-20%, based on income. The administration may consider lowering these rates further and could revisit indexing capital gains to inflation, which would allow for an inflation-adjusted basis, potentially reducing taxable gains upon sale.

Corporate Tax Rates and Incentives Corporate tax policy may also be an area of focus, with proposals to reduce the corporate tax rate from 21% to 15% intended to enhance the competitiveness of U.S. businesses internationally. Other potential measures could include deductions or credits targeting manufacturing, research, and domestic investment.

Estate and Wealth Transfer Taxes For estate and wealth transfer taxes, Trump has indicated support for maintaining the higher exemption levels established under the TCJA. Currently, individuals can pass up to $13.61 million ($27.22 million for married couples) tax-free, with this exemption increasing to $13.99 million for individuals and $27.98 million for married couples in 2025. These exemption levels are set to decrease if the TCJA sunsets at the end of 2025. Keeping these thresholds in place would help limit estate tax liabilities for high-net-worth individuals.

https://www.wilaw.com/what-to-expect-for-tax-policy-in-2025-after-trumps-election-victory/