Federal Debt

Key Concerns:

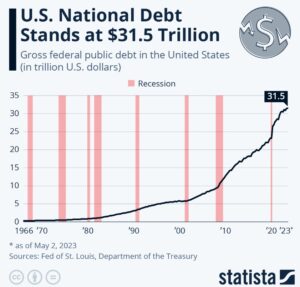

First, our federal debt has reached historically unprecedented levels. We’re not just breaking records, we’re shattering them in ways that would have terrified our grandparents.

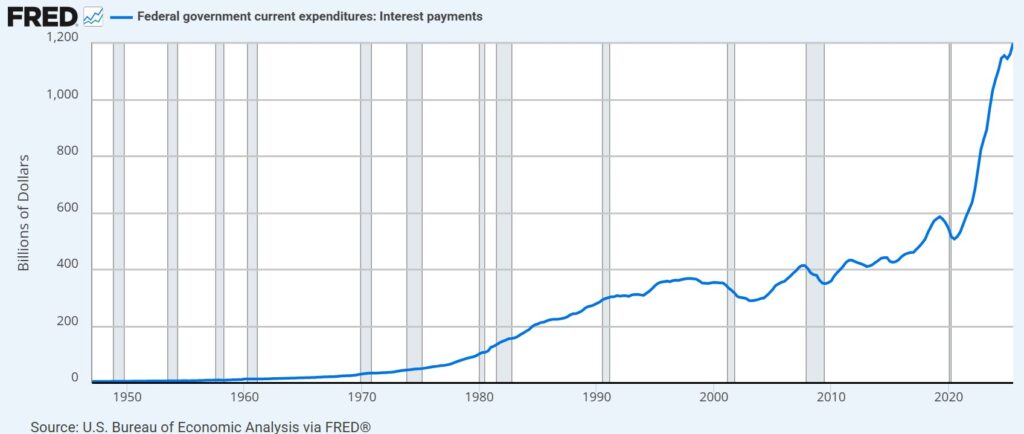

Second, we’re now spending 1.2 trillion dollars per year just on interest payments. Let that sink in. That’s $1.2 trillion that isn’t going to schools, roads, veterans, healthcare, or anything else. It’s just… gone. Paid to bondholders.

Third, this massive debt is actively slowing our economic growth. High debt levels act like a weight around the economy’s neck, making it harder for businesses to expand and for wages to rise.

Fourth, we’ve lost our fiscal flexibility. When the next crisis hits, and it will, we won’t have the financial firepower to respond effectively.

And fifth, perhaps most disturbing of all, we’re essentially writing IOUs that our children and grandchildren will have to pay. We’re partying on their credit card.

Introduction:

When you woke up this morning, your country was $36 trillion dollars in debt. Not millions. Not billions. Trillion. With a T. We are talking about the federal debt and the annual interest charges associated with it.

That’s the reality facing America right now. And here’s the uncomfortable truth: every single one of us is on the hook for it.

If you think this is just another boring academic economic issue, think again. This is about your future, your children’s future, and whether the American Dream survives the next generation.

Project RAD is breaking down the crisis that Washington doesn’t want you to understand, and more importantly, the concrete solutions that could actually fix it.

Below is Project RAD’s plan for reducing our Federal Debt

📘Enact Smart Spending Reforms

🎯 Objective:

Reduce waste, fraud, and duplication across federal agencies without cutting essential services.

✅ Key Actions:

-

Independent Spending Audit: Mandate a bipartisan, third-party audit of all federal agencies to identify inefficiencies.

-

Sunset Review Commission: Establish a panel to regularly assess federal programs and phase out those that are outdated or underperforming.

-

Procurement Reform: Streamline federal contracting and reduce cost overruns, especially in defense and infrastructure projects.

-

Consolidate Duplicative Programs: Merge overlapping initiatives in education, workforce development, and housing.

-

Limit Automatic Budget Increases: Cap discretionary program growth to inflation + population growth unless justified by performance.

📘 Modernize and Strengthen the Tax Code

🎯 Objective:

Raise fair revenue from individuals and corporations while closing loopholes and broadening the tax base.

✅ Key Actions:

-

Minimum Corporate Tax: Ensure all profitable corporations pay at least a 15% effective tax rate.

-

High-Income Surtax: Apply a minimum tax on all incomes above $750,000 to help reduce deficits without impacting the middle class.

-

Close Loopholes and Shelters: Eliminate carried interest, offshore income deferrals, and real estate write-off abuses.

-

Digital and Wealth Taxes: Explore modest taxes on large digital platform revenues and ultra-high net worth individuals.

-

IRS Investment: Fully fund the IRS to improve enforcement and recover unpaid taxes (estimated to exceed $500 billion annually).

📘 Tame Mandatory Spending Growth Without Harm

🎯 Objective:

Control long-term costs in programs like Medicare, Social Security, and Medicaid while maintaining core benefits.

✅ Key Actions:

-

Drug Price Negotiation: Expand Medicare’s ability to negotiate prescription drug prices to save tens of billions.

-

Income-Based Premium Adjustments: Increase Medicare premiums for high-income beneficiaries while protecting low-income seniors.

-

Gradual Retirement Age Adjustment: Slowly raise the Social Security retirement age to 68, with exemptions for physical labor occupations.

-

Strengthen Disability Fraud Prevention: Improve oversight of SSDI and SSI eligibility determinations.

-

Preventive Health Incentives: Invest in wellness and chronic disease prevention to reduce long-term Medicare costs.

📘 Cap and Prioritize Defense and Non-Defense Discretionary Spending

🎯 Objective:

Maintain strong national security and essential services while controlling overall federal outlays.

✅ Key Actions:

-

Audit the Pentagon: Require a clean audit of defense spending; eliminate outdated weapons programs and wasteful contracts.

-

Smart Defense Modernization: Focus funding on cybersecurity, drone defense, AI, and global threat preparedness, not Cold War-era systems.

-

Disaster and Emergency Reform: Pre-fund disaster response based on climate risk modeling to reduce costly emergency bailouts.

-

Education and Infrastructure First: Prioritize discretionary spending that boosts long-term growth and revenue.

-

Cap Discretionary Spending Growth: Tie annual discretionary budget increases to GDP growth or inflation, with emergency exceptions.

📘 Pass a Long-Term Debt Stabilization Act

🎯 Objective:

Create a credible, enforceable framework to reduce debt as a share of GDP over time.

✅ Key Actions:

-

Debt-to-GDP Targets: Commit to reducing the debt-to-GDP ratio to under 90% within 10–15 years through a phased plan.

-

Bipartisan Budget Board: Establish an independent body to review fiscal progress and propose automatic adjustments if targets are missed.

-

Multi-Year Budgeting: Move toward 2-year or 4-year budget cycles to improve planning and limit short-term political pressures.

-

Rainy Day Fund for Surpluses: Automatically allocate budget surpluses to a trust fund for economic downturns and debt paydowns.

-

Ban Unfunded Mandates: Require that all new spending legislation be fully offset with spending cuts or new revenue.

Federal Interest payments $1.2 Trillion/year

TAKE ACTION – Contact Congress

(How to contact Congress) click here

Congressional Committees That Oversee Federal Financing

🔹 Senate Committee on Finance

-

Senate counterpart to Ways and Means.

-

Jurisdiction includes:

-

Taxation, trade, and revenue

-

Debt management and entitlement financing

-

Oversight of Treasury, IRS, and Social Security/Medicare funding

-

🔹 Senate Committee on the Budget

-

Similar to the House Budget Committee.

-

Drafts budget resolutions, monitors federal debt, and analyzes economic forecasts.

🔹 Senate Committee on Appropriations

-

Controls federal spending through appropriations bills.

-

Influences federal financing indirectly by determining program-level budgets.

🔹 Senate Committee on Banking, Housing, and Urban Affairs

-

Oversees:

-

Federal Reserve System

-

U.S. financial markets and institutions

-

National credit policies and debt instruments

-

🔹 House Committee on Ways and Means

-

Primary tax-writing committee in the House.

-

Jurisdiction includes:

-

Federal revenue (taxation and tariffs)

-

Public debt (via Treasury)

-

Social Security and Medicare financing

-

Oversight of the IRS and the tax code

-

🔹 House Committee on the Budget

-

Responsible for:

-

Drafting the annual congressional budget resolution

-

Establishing spending and revenue levels

-

Long-term fiscal planning and federal debt oversight

-

🔹 House Committee on Appropriations

-

Controls discretionary federal spending.

-

Divided into subcommittees that allocate funds to federal agencies and programs.

-

Does not set tax or entitlement policy, but determines how money is spent.

🔹 House Committee on Financial Services

-

Oversees:

-

Federal Reserve System

-

U.S. Department of the Treasury (financial policy)

-

Public and private sector financial markets

-

National debt issuance and federal borrowing practices

-